Finance App Android Mac

- Finance App Android Mac Os

- Finance App Android Mac Emulator

- Finance App Android Mac Sync

- Yahoo Finance App Android

- Free Mac Apps

However well you earn, it is nearly impossible to save some amount until you track your spending. With the ease of payment and rampant culture of plastic money, you don’t think twice before swiping against the goods, which are hardly needed. Had you known the amount you’ve always spent and left with, you would think twice. Well, better late than never, you can start keeping an eye on your expenses and earning with the help of technology.

Quicken App is compatible with iPad, iPhone, iPod Touch, Android phones and tablets. Not all Quicken desktop features are available in the App. The App is a companion app and will work only with Quicken 2015 and above desktop products. The app Mint helps you to organise your expenses so that they do not exceed your income. Download the app. Open AndroidFileTransfer.dmg. Drag Android File Transfer to Applications. Use the USB cable that came with your Android device and connect it to your Mac. Double click Android File Transfer. Browse the files and folders on your Android device and copy files. This is considered one, if not the best home finance app for Mac since it comes with so many finance features, like the built-in calculator, you can also choose from multiple kinds of currencies, and you can even use it to print checks at real time. You can use it to create reports and graphs for different things.

Rather than paying a dedicated time with your daily-diary, use your Android that lets you record your spending on the go. Today, we’re going to talk about 10 best personal finance and budget apps for Android in 2020 for you to select from:

MacOS Big Sur elevates Mac to a new level of power and beauty with a refined new design, major app updates, and more transparency around your privacy. To start with get Chrome Remote Desktop set up on your Windows or macOS machine as well as your Chromebook. Once you launch the add-on, it opens up in a window of its own, letting you access your. Google Chrome is a Web browser by Google, created to be a modern platform for Web pages and applications. It utilizes very fast loading of Web pages and has a V8 engine, which is a custom built JavaScript engine. Because Google has used parts from Apple's Safari and Mozilla's Firefox browsers, they made the project open source. Small programs that add new features to your browser and personalize your browsing experience. Get more done with the new Google Chrome. A more simple, secure, and faster web browser than ever, with Google’s smarts built-in. Chrome macos app store.

See Also: 5 Best Budget Apps For iPhone

1. PocketGuard:

As the name indicates, PocketGuard keeps a sharp eye at your spending by managing your bank accounts, credit and debit cards regardless of which bank is it from. The app syncs your loans, savings, and investment details followed by gathering them at one place so that you can observe and decide your expenses for near future. With 128-bit SSL encoding PocketGuard keeps your data safe with a 4-digit PIN.

Organize your documents with tags. Syntax highlighting. Instant search on your notes. changes are tracked with versions. https://smileever.tistory.com/11.

[appbox googleplay id=com.pocketguard.android.app ]

2. YNAB:

According to the developers YNAB breaks your paycheck to paycheck cycle and help you get out of debt and save more money. Apart from connecting all your bank accounts at one place, it also helps you get out of debt. With ‘You Need A Budget’ app, you can pull the complete report of your spending and earnings. Should you have any query, the support team is there around the clock.

[appbox googleplay id=com.youneedabudget.evergreen.app]

Also Read: 10 Best Android Cleaning Apps – Top 10 Android Cleaner

3. Monefy:

Monefy is an intuitive application that tracks your income and expenses. It allows you to put a widget on display and record any transaction handily. The app provides with a backup and supports multiple currencies. Allowed apps from unknow sources mac. Monefy also lets you use its inbuilt calculator and protects your information with the help of a passcode.

[appbox googleplay id=com.monefy.app.lite]

4. Goodbudget:

Goodbudget is a professional budget application that has myriads of recommendations from global technical giants. Goodbudget lets you sync your data among multiple devices, which empowers you to make your finances arranged with your loved ones too. With this app, you can check your available balance as well as split your spending.

[appbox googleplay id=com.dayspringtech.envelopes]

Also Read: 6 Best Duplicate Photo Cleaner Apps For Android

Finance App Android Mac Os

5. Mvelopes:

Mvelopes is another good finance and budget app for Android in 2019 that brings together all the expenses and earnings and helps you make a better decision towards savings. It uses an envelope budgeting method that lets you plan and track your spending. With Mveopes, you can assign and manage your budget and get feedback when its required.

[appbox googleplay id=com.finicity.mvelopes]

6. Google Sheets:

Finance App Android Mac Emulator

With no surprise, Google is here too. Though, its not a dedicated personal finance and budgeting app; however, it helps you the other way. Google Sheets creates, edit and collaborate with other spreadsheets from your Android. It can be used anywhere and anytime with the support of opening in MS Excel and other such tools. Google Sheets keeps you free of worries as it saves automatically as soon as you type. Along with other formatting and insertions, Google Sheets also lets you share and add comments.

7. Money Manager:

Money Manager is said to be one of the most popular personal finance and budget apps for Android. It automatically records your earnings as soon as they get credited to your account. The app uses graph technology to showcase your spending and earnings that helps you make decision for the rest of the month. Money Manager protects your privacy with a passcode and lets you transfer and between assets.

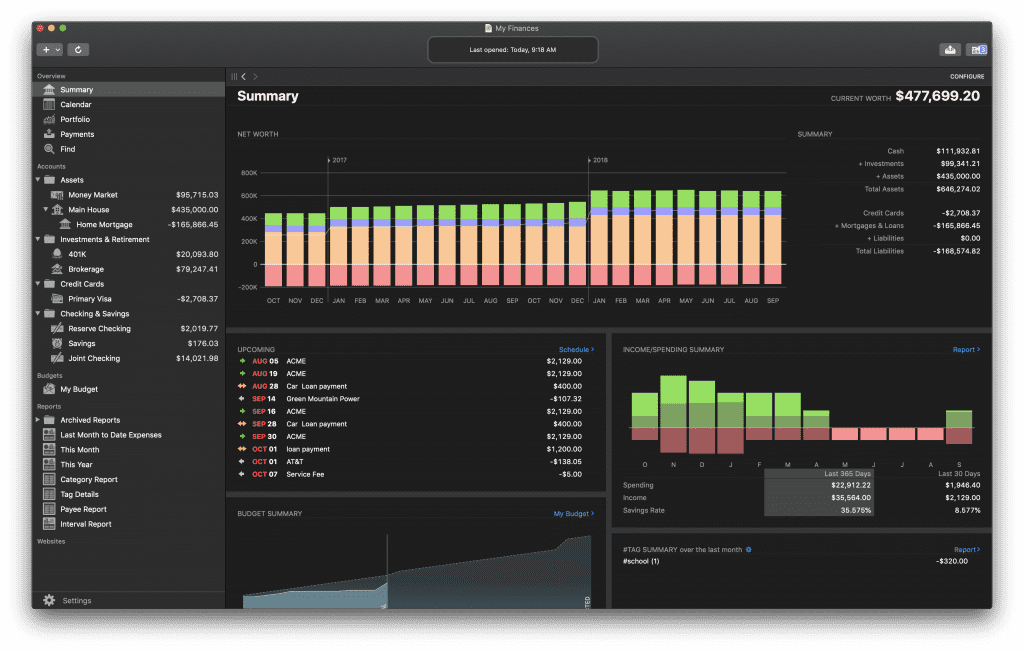

8. My Finances:

My Finances is a expense control tool that also offers to manage your home budget. According to developers, My Finances helps you save more with a keen eye on your spending and selected features. It has a simplified interface that lets you gather your income and expenses in an intuitive way. With My Finances, multi account managing you get your incoming and outgoing funds statistics with a tap that helps you analyze your budget more precisely.

9. Prism Bills:

Prism Bills doesn’t need you to be a geek and helps you anaylyze your funds handily. Prism Bills lets you know about the due date of your bills as well as lets you check your bank statement. Prism Bills offers to have your bills paid with just a swipe. Apart from its operation, setting up Prism Bills is as easy as a piece of cake that includes add bills, add your account and payday, and you’re good to go.

Also Read: Best Duplicate Media Remover Apps For Android

10. Wallet:

Like your own wallet is used to keep your money safe, The Wallet app helps you flexibly plan your budget and track expenses, which keeps you in control and achieve your goals of savings and investments. Wallet just requires you to install it and rest of the operations are done automatically. It automatically updates your bank and plan your budget. To help you track your status, it lets you fetch the insightful reports.

Taking everything into account, you can observe that budgeting apps are certainly of some use. Unlike other manual diaries, these apps are directly connected to your accounts and cards and makes you free of reporting manually. Although, its you who decide to spend or not in the end, but these apps are going to let you know the real time condition of your funds to help you make a decision.

Responses

Every adult needs to keep track of how they spend their money, they need to create budgets to make sure that everything is okay, and even see if there is something left for them to save or spend on themselves after a hard day of work. That’s why here we show you the best home finance apps for Mac.But keeping track of your finance is not as simple for some as it is to others. Some might just not be great with numbers, so this apps are a great way for them to get the right results in a quick way.

But since these are some of the most sought out apps in the market, there are way too many to choose from, so what we are going to is show you some of the ones that are considered the best, because of their simplicity, or because they have some of the best features out there. And you will have to make the choice between these options depending on the features you like and then you can just download it.

The best home finance apps for Mac

Finance App Android Mac Sync

Level Money:

This is the best option you will find out there, to track the movements in multiple bank accounts without having to go through too much trouble and confusion. It also has aat-a-glance feature where you can see how everything is going, and if there is any trouble. You can set up monthly, and even weekly budgets that you’ll be able to keep track of using the feature that was previously mentioned. This app is available for free, and you can also download it to your phone so you can check this things wherever you are at the moment.

Liquid Ledger:

This is considered one, if not the best home finance app for Mac since it comes with so many finance features, like the built-in calculator, you can also choose from multiple kinds of currencies, and you can even use it to print checks at real time. You can use it to create reports and graphs for different things. It’s not a free app, but if you want to try it out if it’s worth to pay for, you can use the 60 day free trial that this platform offers you.

You Need A Budget:

Like the one mentioned before this one is not free, but you can find a monthly plan where you just have to pay $5 dollars a month. But if you are a new users you can just use the 34 day free trial to try it out, but there is also a special offer for users who are in college, they can get it for free as long as they provide proof of their enrollment.

Yahoo Finance App Android

It also has a mobile version, you can use to check all your transaction when you are not on your computer. And it uses Cloud synch to keep all your devices with the same information whenever there is a change made in any of them. You can use all the versions to create different budgets.

Moneydance:

Free Mac Apps

This app serves most of the same features and that the ones that were previously mentioned. It’s considered one of the best home finance apps for Mac devices. And even when it includes so many features it still manages to keep everything looking very clean and not too full. You can choose from multiple currencies, and you can backup every important detail like reports and anything like on your Dropbox account if you choose for that.

Run a program as admin from the contextual menu of its Start Menu shortcut or tile. I created an Adobe Air app that needs to be able to edit the hosts file on a Mac, which you need admin privileges to do. It works with Windows when you run the executable as an administrator. I was wondering how you could do the same on a Mac? If it changes by OS version I'm running Mac OS X 10.7.4. Open the Start menu and click All apps. Find the program you want to always run in administrator. This Tutorial helps to How to Enable Standard Users to Run a Program with Admin Rights without the Password C:WindowsSystem32runas.exe /savecred /user:ngl. Running a mac app in administrator mde login. About OS X account types and running in 'admin' mode. OS X is a multiuser and privilege-based computing environment that sequesters functionality based on various account types, such as.

Budget by Snowmint:

One of the best features that this platform offers you, is the fact that whenever you create a new budget you will be able to see them in the form of ‘envelopes’that you can classified with different uses, like the electrical bills, and then you can see how you have saved for each one. It also comes with a very active support forum and every small upgrade to it will be free for all the users, so this way you only have to pay for this platform once.

AceMoney:

This is a very simple and easy to use app. So for those that don’t have that much experience with this kind of platforms will find it a very nice way to learn. And even if doesn’t come with too many features, it serves the function that you need it to do, so if you are using only for your personal finances and not a company you won’t have any kind of trouble.